From providing finance to catalyzing future investment in the places where it is needed most, DFIs have a key role to play in the crisis, both now and in the future. And while it is impossible to know the full consequences of the public health and economic challenges at hand, DFIs that are adjusting their priorities and adapting their portfolios will be best positioned to provide the targeted support that the world’s most vulnerable communities require.

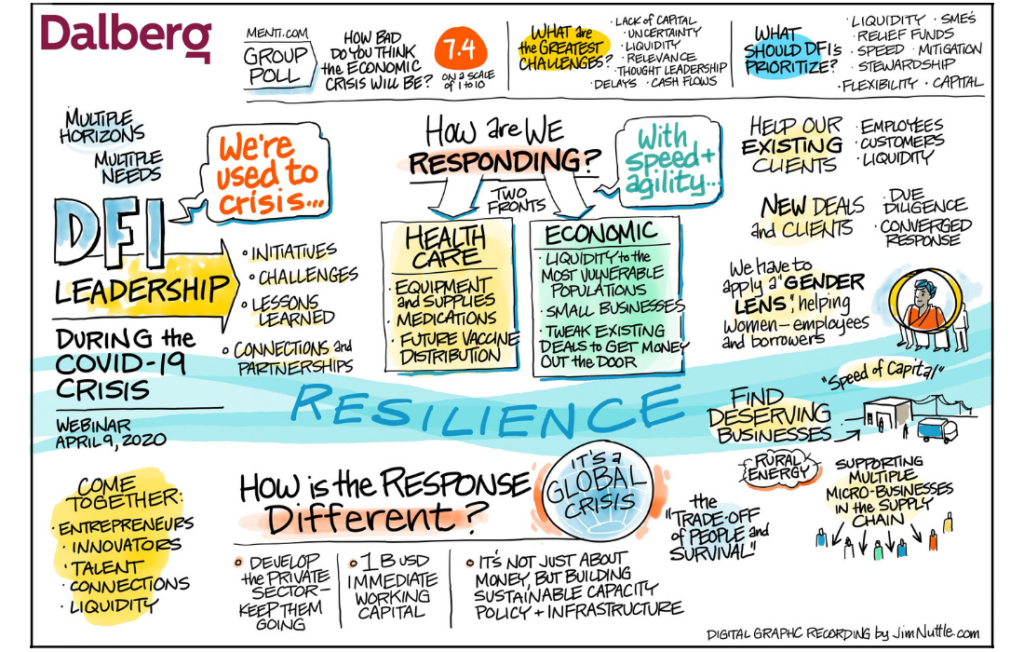

Dalberg went deeper into DFIs’ role in the pandemic on an April 9, 2020 webinar that brought together leaders of five DFIs to discuss their responses to the crisis and likely focus areas moving forward. Panelists included Andrew Herscowitz, CDO of USDFC; Irene Arias, CEO of IDB-Lab; Jonathan Charles, Managing Director at EBRD; Stéphanie Émond, Director at FinDev Canada; and Victoria Sabula, CEO of The AECF. Dalberg’s Yana Kakar moderated the discussion.

Five key insights emerged on how DFIs can effectively respond in the crisis:

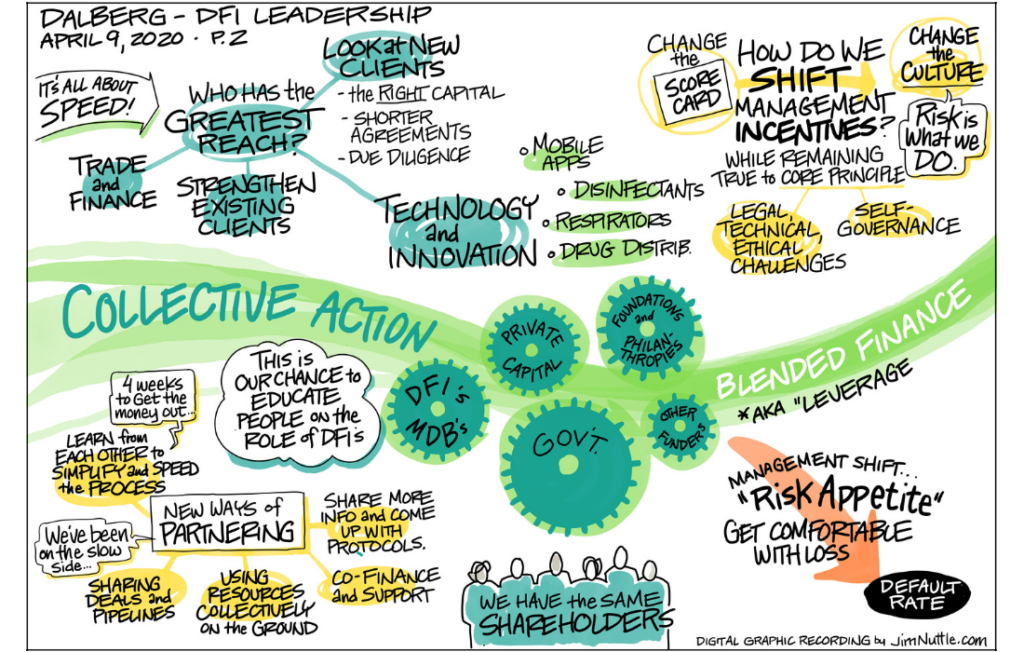

1. Risk appetites must increase.

We need to get comfortable with the concept of loss, as ultimately it’s about leverage. We’re not commercial banks. We serve as a bridge between development agencies that give grants and the private sector. – Andrew Herscowitz, CDO of USDFC

The COVID-19 crisis has created a new economic reality for many businesses in emerging and frontier markets. Independent of size or sector, businesses will see large drops in revenue and changes in cost structure due to social distancing, export controls, and travel bans.

To help businesses survive the crisis and adapt to the new economic reality, DFIs need to reassess their risk appetite and use of concessional financing by revising processes and performance incentives to motivate necessary behavior change. For example, programs such as USDFC’s Portfolio for Impact and Innovation, which aims to bridge the funding gap for early-stage social enterprises, can bypass the Investment and Credit Committees.

2. An inclusive approach focused on marginalized populations is key2. An inclusive approach focused on marginalized populations is key.

Let’s keep in mind that everybody needs support but [there is a need to] focus on those most marginalized – women and girls in particular. –Stéphanie Émond, Director at FinDev Canada

Crises such as COVID-19 have a magnified impact for marginalized populations such as women and girls, migrants, and the rural poor. And as a result, we are seeing some initiatives by DFIs to focus on these populations.

For example, the 2x Challenge and Gender Finance Collaborative released concrete ways to consider gender dynamics in rapid response and long-term recovery. Also, IDB and USAID partnered for the BetterTogether Challenge to crowdsource solutions that support Venezuelan migrants and their host communities facing the pandemic.

3. Support must move beyond just immediate capital and include technical assistance and broader policy reform to ensure resilience.

Investees need technical assistance, not just capital. There needs to be organized technical assistance towards business continuity, risk management, and prioritization. – Victoria Sabula, CEO of The AECF

Many small businesses and entrepreneurs do not have the experience or capacity to face their current challenges, so it is essential to provide them with technical assistance.

For example, EBRD has an Advice for Small Businesses program that leverages their network of international advisers and local consultants to assist a wide range of businesses. DFIs also need to support countries with developing policy capacity in issues such as infrastructure to build resilience in the long-term.

4. Collaboration among DFIs is critical to be able to respond to the crisis in an agile manner.

Cooperation is absolutely crucial, not just relying on everyone’s due diligence, but also about passing along projects to other organizations so that the system as a whole can help. – Jonathan Charles, Managing Director at EBRD

In the past, DFIs have conducted their own due diligence and developed customized impact measurement systems. But in a time of crisis, DFIs should leverage each other’s processes to speed up and simplify deal processing. Opportunities for collaboration include coordinating due diligence and sharing deals that may not be an appropriate fit for one DFI.

Efforts are underway to do this in concrete ways. For example, the DFI Alliance announced they would work to bring liquidity to the market, support companies impacted by the virus, and promote new investment in global health, safety, and economic sustainability.

5. Partnership is not only needed among DFIs but also with other public, private, and civil society actors.

There’s a need to boost public-private partnerships and combine different types of funding… We want these public/private models to have a lasting impact on this process. It is critical for the public and private sector to interact as efficiently as possible. – Irene Arias, CEO of IDB-Lab

Given the scale of this crisis,no individual government or organization has the resources to address all the needs that exist. Partnerships with the public, private, and civil society sectors provide an opportunity to leverage each sector’s unique strengths to develop an effective response.

For example, civil society actors may be able to provide policy expertise to DFIs who are looking to bring together a range of policy stakeholders. DFIs can also partner with the private and public sectors to bring technology and data solutions to scale to address the current health and economic challenges. IDB Lab partnered with Citibeats to launch Civiclytics, a tool that shows the perceptions and concerns expressed by Latin Americans and Caribbean people regarding the COVID-19 pandemic, to help inform potential solutions by the government, private sector, and citizens.

To find out more on these insights and others, you can listen to a recording of this webinar here and check out Dalberg’s recent Op-Ed on how DFI leaders can help emerging-market economies survive the crisis.