Corporate social responsibility (CSR) spending is increasing in India, and is characterized by hundreds of small to mid-sized spenders

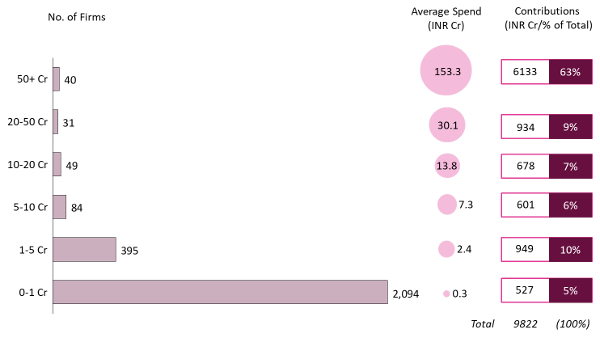

In 2013, the Indian government assumed a unique stance in its effort to address socioeconomic issues by mandating corporations to spend two percent of their net profits on CSR activities. The law solidifies the government’s vision of corporates as essential partners for development. The most recently available data shows 2,691 Indian firms spent almost INR 10,000 Crore (USD1.5 billion) on CSR in the financial year 2015-16, up from about INR 9,000 Crore (USD1.4 billion) in the previous period. As shown in figure 1, CSR contributions are heavily skewed towards the largest corporates, with the top 120 firms accounting for almost 80 percent of total spend. Many of these firms have well-resourced in-house foundations or CSR departments that can systematically deploy funds. But how can the contributions of smaller CSR spenders be better leveraged for impact?

There are some inherent limitations with small CSR spenders

Smaller CSR spenders face some specific challenges that introduce inefficiencies in their CSR models, both in terms of the nature of spending as well as their capabilities and processes to make optimal allocations:

- Few, small, and safe bets. Since the funding amounts are relatively small, they can only be directed to a limited number of projects. Moreover, since small spends are hard to diversify, these companies tend to support conventional projects that deliver more tangible benefits in the short-term, as opposed to innovative or unorthodox projects which the private sector is well positioned to undertake.

- Limited resources to invest in CSR management. Given the 5 percent limit on overheads stipulated by the government, smaller CSR spenders can only deploy a limited amount in its administration. Hence, firms tend to handover the responsibility of the CSR department to individuals who may not have development sector expertise – many times in addition to their day-to-day jobs. This often leads to sub-optimal allocation of funds, with a disconnect between capital deployment and on-ground realities. Firms tend to over-spend on themes that already receive substantial support, such as infrastructure development (e.g., new schools or health clinics), or those that serve their shorter-term self-interests, typically in geographies where they operate.

Theme-based funds that aggregate spending by the small spenders can help address many of these issues

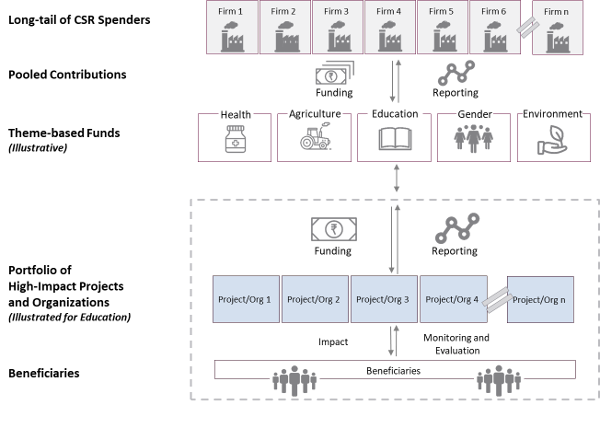

To address these issues, we propose that theme-based funds be created (such as for education, healthcare, rural development, and gender – sectors which are aligned with the activities listed under Schedule VII in the CSR Act), that aggregate CSR contributions from small and mid-sized spenders. Basis our conservative estimates, 8-10 theme-based funds can be created with an annual inflow of INR 50-100 Crore (USD7.5 – 15 million) each, if small/mid-sized CSR spenders were to channel even half of their spending to these funds.

The funds would be structured as not-for-profit entities that are managed by independent development sector and finance professionals, and supported by credible, expert advisory boards. Companies would self-select into the funds they would like to allocate money to, depending on their strategic imperatives and interests.

These funds would not only be able to deploy money into larger, potentially more impactful projects, but also mitigate risk by investing in multiple projects and organizations. In addition, they will help avoid duplicity in effort, increase cost efficiency due to shared administrative overheads, and improve monitoring and evaluation as funds would be incentivized to demonstrate high performance.

Such funds would also make life simpler for not-for-profits (NFPs) looking to raise CSR money. Half of all CSR projects are routed through NFPs; this proportion is likely to be higher for smaller firms which don’t have in-house capabilities. These NFPs will find it easier to secure funding from a fund as opposed to several individual companies. Also, since “lack of good partners and project areas” is a key reason for CSR under-spending, a consolidated fund can significantly reduce search and transaction costs for corporates.

The success of such an initiative hinges on three key factors: conducive policy, collaboration, and robust processes

Firstly, a conducive policy environment. While the CSR Act encourages collaboration between companies to help avoid duplication of managerial efforts, infrastructure, personnel etc., it does not explicitly mention “pooling of funds”. A minor modification in the act could address this. The government has been receptive towards collectivist philanthropy, and there are indications that it is willing to accommodate innovative structures for channeling CSR funding. For example, the Minister of State for Finance, in an interview in 2016, indicated that CSR regulations can potentially be modified to allow investment in social impact bonds.

Secondly, the willingness of corporates to collaborate for the larger good. While firms might be wary of a proposition that potentially reduces the branding benefits and “feel good” of spending directly on development projects, an impactful fund will bring its own signaling benefits. There is precedence of success in collective altruism at the individual level, with platforms such as Dasra, The India Philanthropy Initiative and Social Venture Partners, which bring together high net-worth individuals – and this could very well play out at the corporate level too.

Thirdly, robust and transparent decision-making and reporting processes. Since the funds’ outcomes should be demonstrably better than the status quo, robust and transparent decision-making, monitoring, and evaluation would be critical. It would also be important to ensure that the money is utilized (as only spent money counts towards CSR contribution), and that the funds report detailed project-wise expenditure so that contributing companies can, in turn, report to the ministry. Audit committees, which are accountable to the funders, can be formed for this purpose.

Large, influential foundations can play a pivotal role in anchoring such funds

Large, influential foundations can play a pivotal role in anchoring such funds. They can convene corporates that are genuinely interested in impact—but do not have the bandwidth or expertise—to identify themes of most interest. Thereafter, the foundations will need to think through the mission, theory of change, strategy and success metrics for the funds, before structuring and setting them up, and putting in place truly credible and professional management teams to deploy capital into high-impact projects and organizations.

We strongly believe that pooling CSR spends of the small to mid-sized spenders into theme-based funds can unlock a plethora of opportunities in addressing India’s most pressing development challenges.